32+ arkansas payroll tax calculator

No more surprise fees from other payroll providers. So the tax year 2022 will start from July 01 2021 to June 30 2022.

![]()

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

Ad Payroll So Easy You Can Set It Up Run It Yourself.

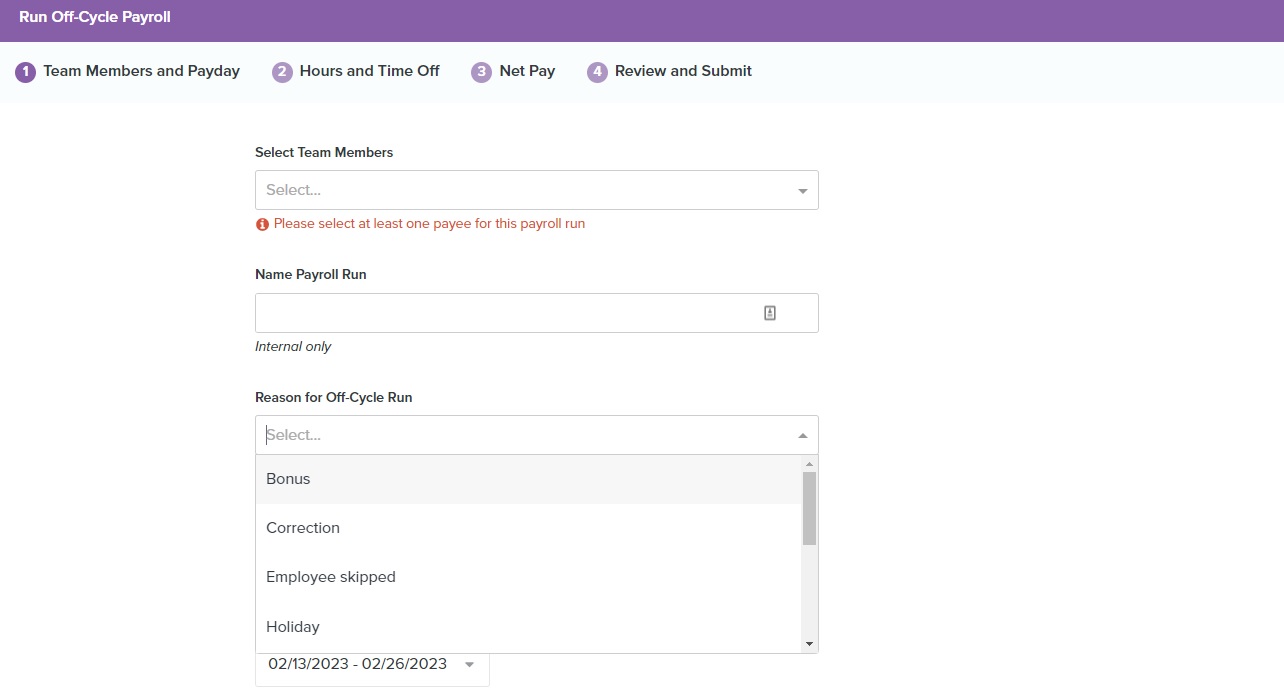

. Web Estimate how much youll owe in federal taxes for tax year 2022 using your income deductions and credits all in just a few steps with our tax calculator. Web Arkansas Paycheck Calculator Use ADPs Arkansas Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Arkansas.

All Services Backed by Tax Guarantee. Ad Boost Your Business Productivity With The Latest Simple Smart Payroll Systems. Web The Arkansas Paycheck Calculator is a tool you can use to get a good idea of how much you will earn per month.

Lets Talk ADP Payroll Benefits Insurance Time Talent HR More. Check Our Payroll Software Comparison Charts To find Out Which One Is Most Suited For You. It can also help you understand your current withholdings taxes.

Ad Get full-service payroll automatic tax calculations and compliance help with Gusto. This marginal tax rate means that your. Free Unbiased Reviews Top Picks.

Get honest pricing with Gusto. Simply enter their federal and state W. Web Arkansas Salary Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and.

Web For employers who pay employees in Arkansas use this guide to learn whats required to start running payroll while keeping compliant with state payroll tax. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. A stabilization rate that changes each year is added to come up with your total tax rate.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Ad Compare This Years Top 5 Free Payroll Software. Employers can use it to calculate net.

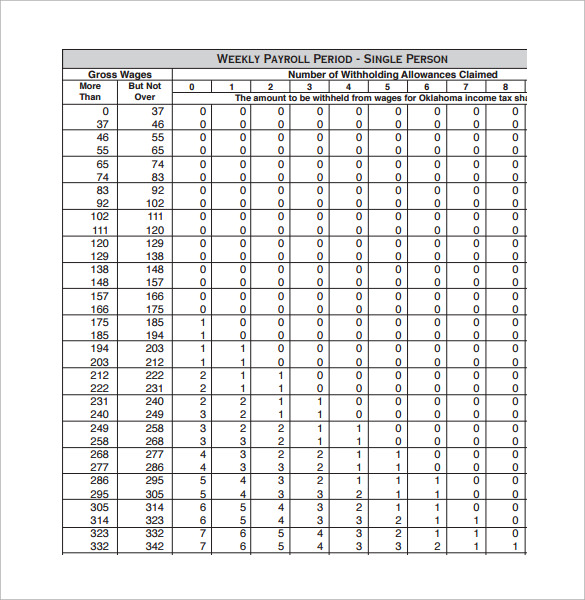

Web The 2022 tax rates range from 2 on the low end to 55 on the high end. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Get Started With ADP Payroll.

Employees who make more than 79300 will hit the highest tax bracket. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. The state income tax rate in Arkansas is progressive and ranges from 0 to 55 while federal income tax rates range from 10.

Web Arkansas tax year starts from July 01 the year before to June 30 the current year. Web What is the income tax rate in Arkansas. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

Web Rates for Arkansas unemployment tax vary and range between 01 to 50. Web If you make 70000 a year living in Arkansas you will be taxed 11683. No more surprise fees from other payroll providers.

Ad Get full-service payroll automatic tax calculations and compliance help with Gusto. Web Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. Ad Process Payroll Faster Easier With ADP Payroll.

Web For each payroll federal income tax is calculated based on the answers provided on the W-4 and year to date income which is then referenced to the tax tables in IRS Publication. Your average tax rate is 1167 and your marginal tax rate is 22. Just enter the wages tax.

Get honest pricing with Gusto.

Pdf Sexual Dimorphism Of The Developing Human Brain Judith Rapoport Academia Edu

Bonus Pay How To Calculate Work Bonuses And Tax In 2023

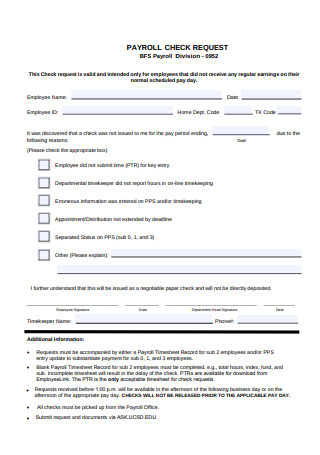

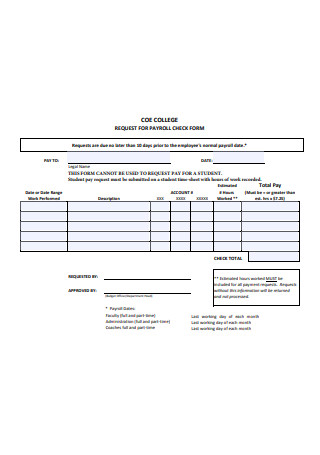

34 Sample Payroll Checks In Pdf Ms Word Excel

How To Calculate Payroll Taxes Wrapbook

34 Sample Payroll Checks In Pdf Ms Word Excel

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

2525 Huffine Mill Road Mcleansville Nc 27301 Compass

Insurancenewsnet Magazine September 2019 By Insurancenewsnet Issuu

866 Highway 107 S Del Rio Tn 37727 Zillow

How To Calculate Payroll Taxes Wrapbook

![]()

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

Arkansas Hourly Paycheck Calculator Gusto

Payroll Tax Wikipedia

Cooking Up Something In The Classroom Carolina Weekly

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Pdf Probability Model Of The Genesis Of Covid 19 In Wuhan China Greg Brundage Academia Edu

1111 West Keene Road Apopka Fl 32703 Compass